Houston Real Estate Market Trends 2025: What You Need to Know

What’s happening in Houston’s housing market right now and what it means for buyers, sellers, and investors

In 2025, Houston’s real estate market is navigating a balance between opportunity and caution. While inventory is up and affordability challenges persist, fundamentals like job growth, population influx, and strong demand in specific segments are keeping the market dynamic. Let’s dive into the current trends shaping real estate in the Houston metro.

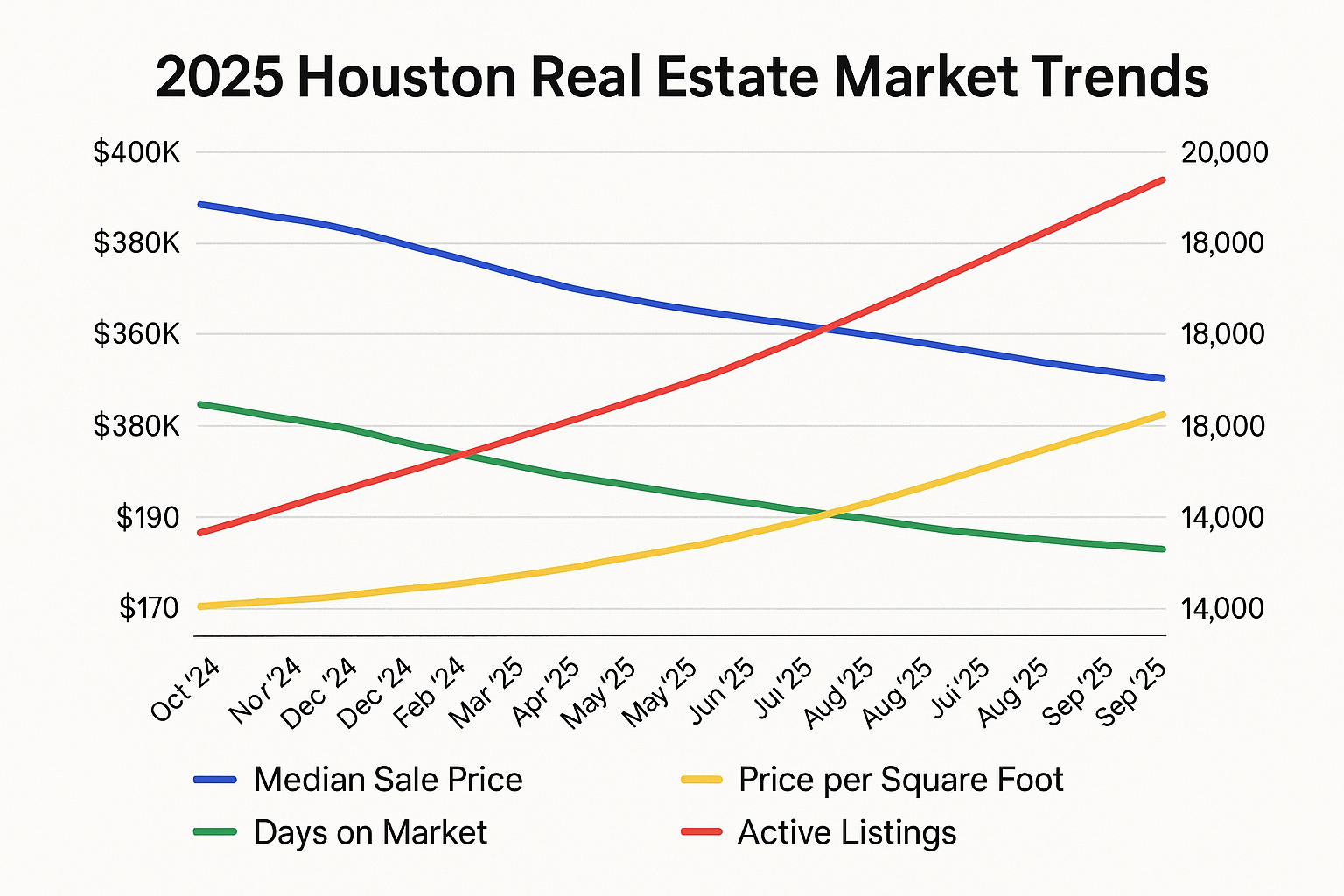

???? Key Market Indicators

- Higher inventory & slower sales velocity

Active listings in Houston have surged (some reports show a ~30% YoY rise), giving buyers more choices. Homes are spending longer on the market average days on market rising compared to previous years. - Home prices: Mixed signals, selective strength

Some sources report modest declines or cooling in listing prices. Yet, for well-located, updated, move-in ready homes, demand remains strong, supporting stable or even slight appreciation in selective submarkets. - Mortgage rates & affordability pressures

Rates remain elevated by historical standards, which constrains what many buyers can afford. Even with increased inventory, purchase power remains tight for many middle income buyers. - Luxury & high-end housing showing resilience

The luxury segment is holding up better than many expect. Buyers in higher tiers are often less sensitive to mortgage rate shifts, which helps sustain demand in premium neighborhoods. - Rental & multifamily demand remains strong

As purchasing becomes harder, more households are opting to rent. The shortage of new apartment construction (due to cost pressures) could push rents higher in some areas. - Suburban & peripheral growth

Many buyers are shifting toward suburban or exurban neighborhoods where land is more available and prices are more forgiving.

???? What It Means for Buyers, Sellers & Investors

Buyers

- More leverage than in overheating markets with higher inventory and slower sales, there’s room to negotiate.

- Be selective: Homes in better condition, strong locations, or with desirable features will outpace average homes.

- Prepare for tradeoffs: You may need to balance size, condition, and location to fit within your budget.

Sellers

- Pricing is more critical than ever. Overpricing in this climate often leads to extended days on market.

- Homes that are well-maintained, staged, and competitively marketed will attract the strongest offers.

- Flexibility in terms such as closing dates, minor concessions, or repairs can be the differentiator.

Investors

- Multifamily and rental properties may offer strong opportunities, especially as more residents rent.

- Value-add properties in emerging neighborhoods may provide upside as infrastructure and services improve.

- Be cautious about overpaying in saturated or high cost new construction areas.

???? What to Watch Next (Outlook for 2025–2026)

- Interest rate direction: Any movement downward by the Fed could boost buyer demand.

- Economic and job growth: Houston’s varied economy (energy, healthcare, logistics) helps support stability.

- Supply trends: Whether inventory continues to rise or stabilizes will deeply impact price movement.

- Neighborhood bifurcation: Some submarkets will outperform others local insights will matter more than ever.

Final Takeaway

Houston’s real estate market is in a recalibration not retreat. With more inventory, slightly lower rates, and a slower pace, the door is open for more thoughtful, strategic moves whether you’re buying, selling, or investing.

If you’re considering a move or want to explore your options, let’s connect. Schedule a time to talk and I’ll help you navigate your next step with clarity and confidence.

Posted by Charles White on

Leave A Comment